Why I Quit My Job to Build a Climate Tech Company

Climate change represents the challenge and opportunity of a lifetime. Why I’ve decided to dedicate my career to it and how I plan to have an impact.

I was a vice president at a tech unicorn, managing hundreds of people, killing myself in an intense pressure cooker, and spending more time on airplanes than my own apartment. Did it feel sustainable? No. But if I hung on just a few more years I could retire in my thirties with a nice nest egg and then I could call my own shots (or so I told myself). Yes, it was stressful, but I loved the adrenaline of the work and I loved the brilliant people I worked with - so why walk away?

My heart just wasn’t in it. In late 2019 I was driving back from a beautiful weekend hiking in the mountains and it hit me - I wasn’t living my values. I grew up in rural Connecticut (that’s 860, not 203) surrounded by forests, lakes and streams. My fondest memories are of being literally buried in snow. Yet, here I was day in and day out racing my gas-guzzling car down the 101 to work, surrounded by a cement jungle. Every week I was on an airplane, callously adding to my carbon footprint.

Meanwhile, everywhere I went I was reminded of the devastating effects that anthropogenic climate change was having on our day-to-day lives. I saw it first-hand in 2017 when volunteering at the Brighter Futures school in New Delhi (the air pollution was so bad you could taste it), and while on a work trip when I took the opportunity to visit the bleached coral reefs off the cost of Cebu in 2018. It really hit home for me watching the San Francisco sky catch fire in late 2020.

Everywhere I looked, climate change was making life harder for people. So I decided it was time to take the leap that I’ve been thinking about off and on ever since I moved to the Bay Area in 2013. I quit my job and decided to start a company. I am under no illusion that the ability to consciously make a decision like this is an incredible privilege in and of itself. That makes me even more determined to make this next chapter in my life a success - the difference is, my criteria for what defines success are deeply aligned to the things that will create a more sustainable future for our world.

But where to start? I want to build a business that reverses the impacts of climate change. It’s an ambitious goal and one I certainly don’t plan on tackling alone. So I’m joining a forward-thinking VC firm, OMERS Ventures as an entrepreneur-in-residence (EIR) focused on Climate Tech. What’s an EIR? It’s effectively someone that a VC firm hires for 6 to 12 months to incubate a new startup which that VC firm could potentially fund.

Climate change is already here and we cannot ignore it

Climate change is the single greatest risk to the world today. In the last 9 months, Covid-19 has killed over 2 million people worldwide. During that same time wildfires claimed 4 million acres of California forest at an economic cost of $100 billion, while in the Canadian Arctic thawing permafrost caused houses and roads to sink as temperatures soared to 100F. But what do these climate tragedies and a deadly pandemic have to do with one another? They are inextricably linked. As the Chief Scientist for ESRI Dawn Wright explained on The Science of Where Podcast earlier last year, the Covid-19 pandemic is an undesired side effect of human encroachment into animal habitats. Covid-19 might just be the beginning, considering the Arctic ice holds remnants of the Spanish Flu and who knows what else, as it melts and millions of years of ancient bacteria are released into the atmosphere.

We are not doomed

I don’t think we are doomed, at least not yet. I’m not a climate scientist, but after spending the last year reading everything I could get my hands on, I see reasons for optimism. Hear me out. Wind and solar recently passed coal as the cheapest sources of energy on the planet; over the last 10 years the average cost per kilowatt hour for solar and wind energy dropped 5x to $0.03 $/kWh. Meanwhile lithium iron battery costs have dropped 6x to $150 $/kWh and are expected to drop below $100 by 2024, reaching $60 by 2030. We have all the tools we need to completely electrify our economy today - the only thing stopping us from reaching net zero is blocking and tackling.

From Green-Tech fiasco to the Biggest Investable Market

The last time Silicon Valley got excited about investing in climate solutions it brought us the “clean tech” bubble of 2004 to 2011 in which VCs lost over half of the $25 billion invested. The poster child of this bubble was the solar panel company Solyndra which cost the government over $500 million dollars. Why then, despite the headline failure of that era are we seeing investors return to climate investing in droves?

The clean tech bubble wasn’t all bad: There were some massive successes, like Tesla, SunRun and Beyond Meat; it just took these companies longer than the typical venture backed software business to scale.

Conscious consumerism has arrived and is driving corporate change: 70% of US and Canadian consumers prefer purchasing from brands they perceive as eco-friendly, and corporates have heard them loud and clear. Headlined by companies like Unilever ($1 billion plus climate and nature fund) and Microsoft (committed to going carbon negative by 2030), over 1,500 companies with combined revenue of $11.4 billion have committed to reaching net zero emissions by 2050. That’s 1,500 potential customers for climate startups.

Some of the whiz-bang technology of yesterday is now scalable: Much like how the over-investment in internet infrastructure during the original dot-com bust paved the way for Wifi, SaaS and the consumer internet boom, the “over-investment” in solar and wind during the clean tech bubble ultimately led to solar and wind becoming the cheapest sources of energy on the planet.

Climate Tech ≠ Clean Tech: The clean tech bubble focused primarily on alternative energy solutions (like ethanol, solar, hydrogen and wind power), requiring massive investments in fundamental R&D, manufacturing and large capital expenditures which made it a bad fit for traditional venture investing. Climate Tech is an investment theme which touches every sector of the global economy. It is not solely dependent upon technologies still in the lab but instead leverages the breakthroughs of the last 10 years (AI, SaaS, cloud computing, improved geospatial modeling, faster compute power and business model innovation), and applies those breakthroughs to the climate challenge. Here are a few examples that don’t look like clean tech bubble businesses:

Dandelion Energy is displacing the $200 billion oil/gas heating and cooling market in New England with Geothermal energy;

Blueprint Power empowers commercial building owners to help balance the grid via demand response and energy storage, and earn incremental revenue while doing it;

Pachama is using satellite imagery to create a marketplace for carbon offsets with transparency as to the actual quality of those offsets;

Unspun reduces apparel industry waste by providing brands a platform for custom clothing design and manufacturing;

Finch empowers consumers to shop sustainably by crunching disparate data sets to find the most planet-friendly consumer products.

A $39 trillion market: That’s the combined GDP of all the nations that have committed to reaching net zero by 2050. That’s 20x the size of the $2 trillion global energy market that clean tech investors were pursuing during the clean tech bubble. These countries don’t care how they achieve net zero, they are looking to remove carbon emissions wherever they can. Remember carbon is not just emitted by power plants and cars. The blue jeans you are wearing required carbon to manufacture and ship to you, and consume carbon whenever you put them in the washer. The buildings you live and work in cost carbon to be created and use it to heat and cool themselves.

Why there is hope

The feds have finally arrived! Just last week on “Climate Day” President Joe Biden made it clear there will be aggressive federal support for combating climate change over the next four years. He did the obvious (rejoined the Paris Agreement), the bold (suspended new leasing of federal lands and waters for oil and gas production), and the type of stuff that gets us climate geeks fired up (finally mandated federal agencies to put an end to oil and gas welfare programs, and committed to electrifying the entire 650,000 federal vehicle fleet).

Lessons from covid: If the Covid-19 pandemic has taught us anything, it is that with the right people, capital, focus and incentives we can conquer any challenge (we created a world saving vaccine in just 9 months). Similarly, the opportunities to turn the tide and reverse climate change are not insurmountable. I am spending the next 6 months researching two large areas in which to find co-founders and build a transformative business:

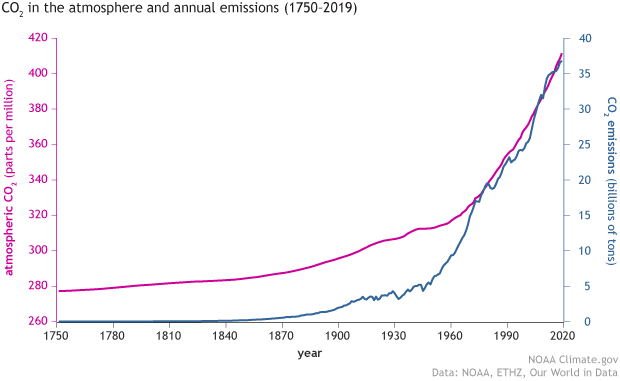

In the short-term, let’s stop the bleeding and stabilize the patient: As you can see from the graph below, we are currently emitting about 40 billion tons (“gigatons”) of CO2 per year. We need to reach net zero emissions asap if we are to have a chance at holding global temperature increases to only 2°C. The good news is we have the tools we need to get the job done. We just need to hurry up and get more electric vehicles (EVs) on the road, more solar panels on rooftops and more wind turbines spinning.

In the long-term: I’m looking at how to remove CO2 from the atmosphere. This is something that most people don’t really understand (at least I didn’t!). As the above graph shows, there is currently 417ppm of CO2 in the atmosphere, which is a direct result of all that CO2 emitted since the industrial revolution. Carbon Dioxide is a very long lived gas; once released into the atmosphere, carbon hangs around for 300 - 1,000 years. In fact, even if we achieved net zero tomorrow, Ralph Keeling (Director, Scripps Institution of Oceanography’s CO2 Program in San Diego) reports that it would take 10,000 years for the atmospheric concentration of CO2 to return to pre-industrial levels. So we need to engineer a way to remove that CO2 from the atmosphere if we want to return to normal earth temperatures. Lately I’ve been enamored with carbon capture, utilization and storage (CCUS) as a potential solution. However the math just doesn’t pencil out yet. All forms of carbon capture require energy to capture the carbon and store or utilize it and are not unit economic positive today. Shouldn’t we use what renewable energy we have today to eliminate the need for all coal, natural gas and oil first, rather than risk giving fossil fuels a license to continue to operate? That said I remain bullish on the potential of this technology, so if you disagree please reach out to me on Twitter @cgebersol - I would love to be convinced otherwise.

Ideas I am currently exploring:

Accelerate adoption of EVs with new financing structures: I currently drive a traditional gas guzzler. I’d rather own an electric vehicle (EV). EV’s are expensive and Covid-19 hasn’t been kind to the resale value of my 8-year old car. There is a complex web today of federal and state incentives for buying an EV that is confusing to navigate. I’m interested in building a marketplace that streamlines the process for obtaining federal and state EV incentives and adds in corporate carbon offset dollars as an additional incentive for more consumers to go electric.

Blockchain-enabled peer-to-peer energy trading: I see a future where you can sell energy from your solar panels to your neighbor. That’s not possible today (yes you can sell it back to the grid via net metering, but I’m talking about true democratization of the energy markets). It’s only a matter of time before blockchain or distributed ledger technology enables real time data on energy flows to better balance the load from distributed energy sources and enable things like peer-to-peer energy trading.

Carbon negative city blocks: I’ve been digging into residential energy solutions like solar and geothermal heating with my colleague and property tech expert, Michelle Killoran. Current residential solar adoption in the US is ~3% and Geothermal is sub 1%. The adoption is shockingly low despite the long-term cost savings available to consumers. The reason: regulatory red tape. I’d like to work with a local municipality to electrify an entire city block as a pilot project (solar, batteries, water pumps, geothermal, in-stream waste-water hydro, bio-fuels… the works). We could prove out the concept and then scale to tens of blocks and ultimately cities.

Insuretech as a way to drive behavior change: I saw first hand during my time at Health IQ how innovations in insurance underwriting, pricing and distribution can drive change. Resident insuretech guru Alyssa Spagnolo and I are interested to explore how insurance companies will adjust to increased catastrophic risk and how that might drive corporates, governments and consumers to make more climate friendly decisions and investments.

Intersection of climate-tech and health-tech: My colleague Christina Farr and I are interested in opportunities that tie better health outcomes to better climate outcomes. You need look no further than the Covid-19 crisis to see how inextricably tied climate and health are.

Building a new electric utility from the ground up: When I say this to most people they tell me I am crazy - which in turn only makes me more interested 😀. If we are to reach net zero and electrify everything we are going to need a grid that can accommodate 4x what today’s aging grid can handle. In order to do so we need billions of dollars worth of new transmission, storage and software that can better manage bidirectional flows of energy (today’s grid was built for one-directional energy only). Yes, the grid is not owned by just utilities, but a complex web of public and private entities. However as Apple and Tesla have shown, the best products and customer experiences are often the result of full-stack businesses and hence my interest in building a new utility.

Airbnb for EV charging: I am super impressed by what Chargepoint and Volta are doing, but why shouldn’t consumers find a way to participate in the potential revenue from the EV charging ecosystem as well. I’m not convinced the Airbnb model is the right one, however I expect EV charging will eventually be much more distributed and easier to access than gas stations are today, and that therein lies opportunity for innovation.

Why OMERS Ventures?

I’ve chosen OMERS Ventures because I believe building a transformative company in Climate Tech requires 3 things:

Trusted partnership

A partner with a shared value system

Deep capital reserves to back an ambitious goal

Trusted partnership: During my time at Comcast Ventures I had the privilege of working with an incredible VC, Michael Yang, who has a successful track record of incubating new businesses like Brightside and partnering with entrepreneurs to create industry defining companies like Accolade. I am thrilled to be working closely with Michael again!

Shared value system: OMERS has been a leader in responsible investing: as an early signatory to the TCFD disclosure requirements, one of 8 large pension plans calling for standardized TCFD and ESG reporting, and building the first two zero-carbon office towers in Canada.

Deep capital reserves: With over $109B assets under management and significant investments in the real estate and transportation sectors, OMERS is no stranger to big challenges and has the capital to support transformative innovation.

OMERS continues to amaze me. The organization has expertise across a broad spectrum of areas within Climate Tech. A big part of solving climate change is figuring out how to decarbonize infrastructure and physical buildings. I am fortunate to have access to experts in both those fields: Oxford Properties (which manages over 100 million square feet of office, industrial, retail and residential property) and OMERS Infrastructure (owner and operator of airports, ports, tunnels, bridges, electric utilities, nuclear power plants, wind and solar farms). It is expertise that I hope to be able to tap into over the coming months.

The Road Ahead

I realize I have a long road ahead, and that finding a way to address one of the world’s most pressing problems will not come easily. But I also believe that we have a fighting chance of solving these giant problems if we can look at the component parts of each issue, and start to chip away at the problem one step at a time. I have a once in a lifetime opportunity to pour all of my business-building know-how into something I am deeply passionate about. I don’t take that responsibility lightly.

If you’re an entrepreneur, a scientist, an operator or an investor excited about reversing climate change please reach out to me cebersol@omersventures.com. I would love to connect and figure out how we can work together to keep the arctic frozen, the rainforest wet and the great barrier reef intact!

Christian - This is so well written, great job! You've broken down a complex problem into bite-sized pieces. I'm excited to see this career change!

Christian, I am so proud of you. We must all roll up our shirtsleeves and begin the work of living sustainably.